This is rectified by elevation certificates. If the elevation of a structure in a 100-year zone is unknown, a worst-case depth will be assumed. The further the structure’s elevation is below the Base Flood Elevation, the greater the risk, and consequently the higher the flood insurance premium. So, a structure with an elevation equal to the Base Flood Elevation at that location would be at the 1% chance. The Base Flood Elevation can be thought of as the elevation at the edges of the 100-year line. Therefore, V zones will be the most expensive, followed by A zones, with C or X zones having the lowest premiums.Īs was previously alluded to, elevation plays a key role in determining the zone it also is a factor for determining the cost of an insurance policy.

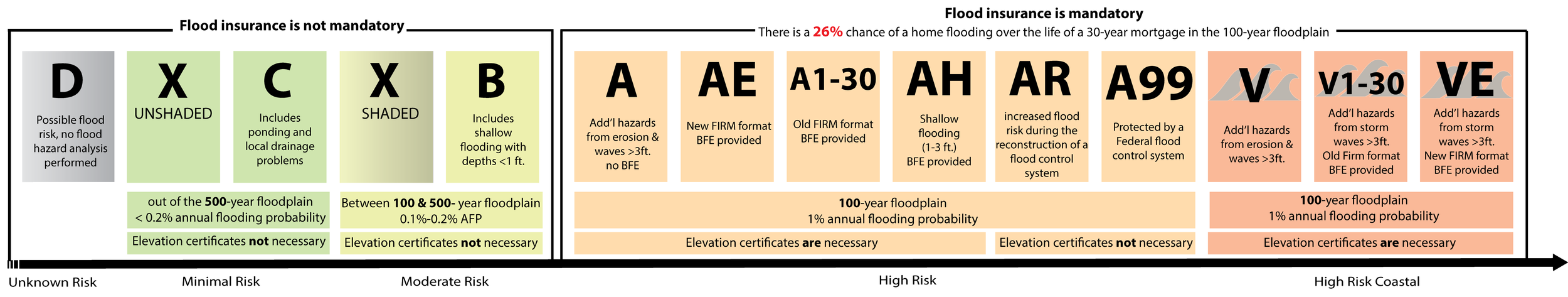

The zone is one of several factors in rating government-backed, National Flood Insurance Program (NFIP), insurance and almost all private carrier policies. Naturally, the higher the risk, the more expensive flood insurance premiums will be. To be protected from flooding caused by storms, you need a special flood insurance policy. Homeowners policies only cover water damage caused by things like burst pipes. AE and VE are used on newer FIRMs instead of A# and V#. Many older maps show the base flood elevation relative to a datum in the zone itself (e.g. If the second letter of your zone is “H”, that means ponding or shallow flooding. Base flood depths (1, 2, or 3 feet) are provided instead of Base Flood Elevation. If the second letter of your zone is “O”, that means shallow flooding with sheet flow is expected with a 1% chance in any given year. Zone AE, Zone VE), that means the flood map is printed with flood elevation information. If the second letter of your zone is “E” (e.g. Not all zones have a second letter, but some do and each of them represent something different. Further, if your flood zone is a B or an X with shading on the map (aka X500), that means it is a 500-year floodplain not a Mandatory Purchase area, but one of higher risk than the “C” or “X” (unshaded) zones. If your flood zone is “X”, “B”, or “C”, that means it is not a 100-year floodplain and the government doesn’t require you to buy flood insurance. An “A” zone could also be caused by ponding, or the collection of rainfall. If your flood zone is “A” or starts with an “A”, it is a 100-year floodplain and the flooding is caused by non-coastal waters, which includes rivers, lakes, ponds, streams, and other fresh-water sources. That’s the water that surges on the coast during a storm and spreads inland. If your flood zone is “V” or starts with a “V”, it is a 100-year floodplain and the anticipated flooding is caused by coastal water. So, what do those zone letters mean and how are they related to your flood risk? If your property is in a zone beginning with an “A” or a “V”, your federally regulated lender will require you to purchase a separate flood insurance policy.

Each of those boundaries is labeled with a Flood Zone letter, and sometimes an additional letter or number. FEMA uses engineering standards to draw the 100-year (1% chance in any given year), and sometimes the 500-year (.2% chance in any given year), floodplain boundaries. The Federal Emergency Management Agency (FEMA) creates Flood Insurance Rate Maps (FIRMs), which are the official maps of a community on which FEMA identifies flood hazard areas (zones). Even so, it is hoped this information helps those not directly involved in the industry understand the basic terms and how they relate to flood risk and flood insurance rates. may note that this information is high-level and not every variable is covered. Floodplain Managers, flood insurance professionals, surveyors, etc. This article is written to aid property owners regarding their flood risk.

0 kommentar(er)

0 kommentar(er)